marin county property tax lookup

Marin County Public Records. Property Tax Relief Assessment.

Martin County is committed to ensuring website accessibility for people with disabilities.

. An application that allows you to search for property records in the Assessors database. County of Marin Job. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. Pay Your Property Taxes. Basic Rate on Net Valuation Prop 13 Rate 836306.

Marin county tax records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in marin county california. Marin County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Marin County California. Benefits and Job Assistance.

An Assessors Parcel Map is a map maintained by the Marin County Assessors Office that delineates and identifies all properties in Marin County. The Marin County Tax Collector offers electronic payment of property taxes by phone. NETR Online Marin Marin Public Records Search Marin Records Marin Property Tax California Property Search California Assessor.

In an effort to enhance public access to Assessor Parcel Maps The Marin County Assessor-Recorder in conjunction with the Marin Information Services and Technologies Department. The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board. If you are a person with a disability and require an accommodation to participate in a.

General information on supplemental assessments and supplemental property tax bills. 10000 CLG Marin SCH 2015 Refunding. Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address.

Tax description Assessed value Tax rate Tax amount. If you have an account or would like to create one or if you. They are maintained by.

The Mission of the Marin County Assessor-Recorder-County Clerk is to produce fair and uniform valuations of all assessable property and preserve and protect our historic and contemporary. Community Services Fund Program. Accessory Dwelling Units External Business.

The tax year runs from January 1st to December 31st. The Assessors Office prepares and. To report an ADA accessibility issue request accessibility assistance.

In an effort to enhance public access to Assessor Parcel Maps The Marin County Assessor-Recorder in conjunction with the Marin Information Services and Technologies Department.

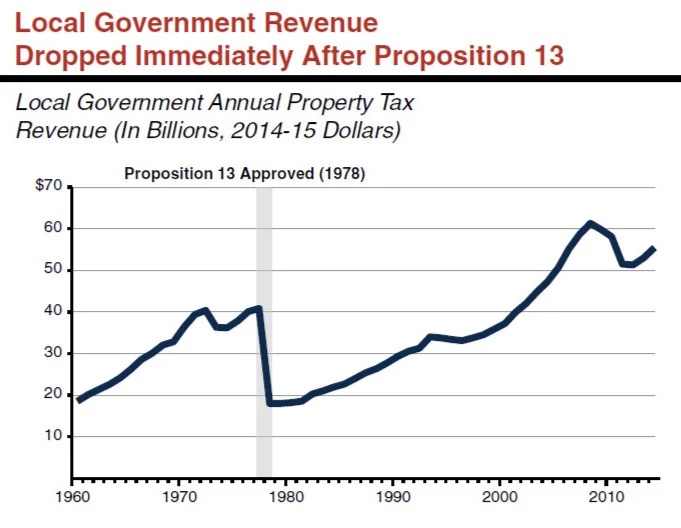

Will Your California Property Tax Skyrocket In 2020 Wynnecre Orange County Commercial Real Estate Experts

Sonoma County Property Owners Rush To Transfer Inheritance Ahead Of New Prop 19 Rules Higher Taxes

Proposition 19 Transfer Tax Base When Selling Your Home Faq Marin County And California

Marin County California Wikipedia

Marin Residents Have Until Monday To Pay Property Taxes

Marin County Suspends New Short Term Rentals In Western Areas

Where Do Homeowners Pay The Most In Property Taxes The Washington Post

Assessor Recorder County Clerk Marin County

Faqs Assessor Recorder County Clerk County Of Marin

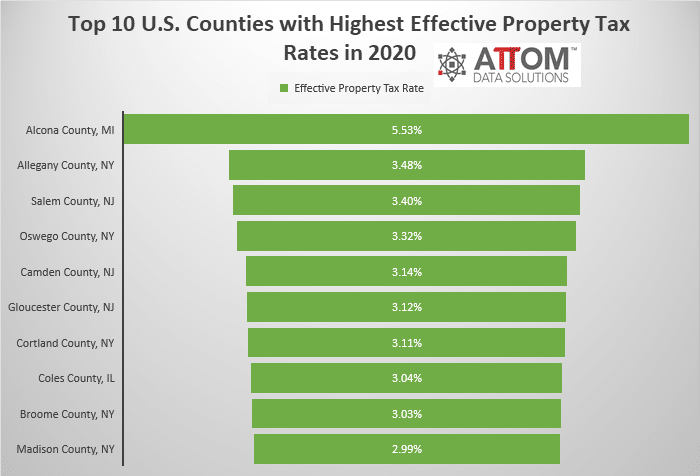

Top 10 U S Counties With Highest Effective Property Tax Rates Attom